New reforms in Nigeria’s oil and gas industry are set to create frontiers for new investments in West Africa’s largest oil producing country.

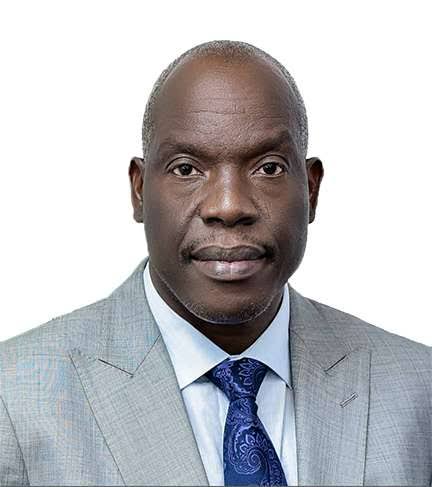

Following the implementation of the Petroleum Industry Act 2022, several oil companies are returning to their abandoned fields, while new ones are also going to be developed, chief executive of the Nigerian Upstream Regulatory Commission (NUPRC), Gbenga Komolafe revealed at an industry conference held in Abuja on Wednesday.

According to him, efforts to remove barriers to investments are crystalising into new investments as about 20 oil rigs are in production, adding that the commission has rolled out the regulation on measurement, the first of its kind since oil was discovered, to stem losses from oil production.

Also speaking at the event, head of Nigerian Petroleum Investment Company (NAPIMS), Bala Wunti said projects like Agbami gas, and Exxonmobil’s Owowo field among others have seen renewed commitments from investors.

He said; “We are significantly advancing on the Agbami gas project, which is bringing in a significant couple of billions of foreign direct investments.

“On top of that, we all know the Owowo project, which Exxon has put in the freezer has been unfreezed courtesy of the PIA and removal of the PSC, put all these together we see an outlook of between this year and next year, of somewhere in the neighbourhood of between $18billion and $20 billion.”

The Petroleum Industry Act, 2022 offers improved regulatory and fiscal terms for oil production arrangements, especially for those onshore fields where investors have fled due to crude theft, sabotage, and community agitations.

According to a Businessday report, last August, the Nigerian National Petroleum Company (NNPC) Limited signed a contract extension with its international oil companies partners for five major oil blocs. This also improved terms for agreements such as the Production Sharing Agreement, Dispute Settlement Agreement, Settlement Repayment Agreement, and Escrow Agreement.

Komolafe said the ultimate objective of act is to actually monitor production on a real-time basis.

Data from the NUPRC states that 40% of crude oil losses in the Nigerian petroleum industry are due to measurement inaccuracies which this new regulation aims to curb.

In a newfound drive to convince investors, Komolafe said the Commission seeks to become business enablers, leveraging regulations to create an enabling environment for investments in Nigeria.

“We are creating regulatory incentives that makes issuances quicker in a manner that will shorten turnaround time and that will impact favorably on the unit cost of production because businesses are looked at on the basis of profitability,” he said